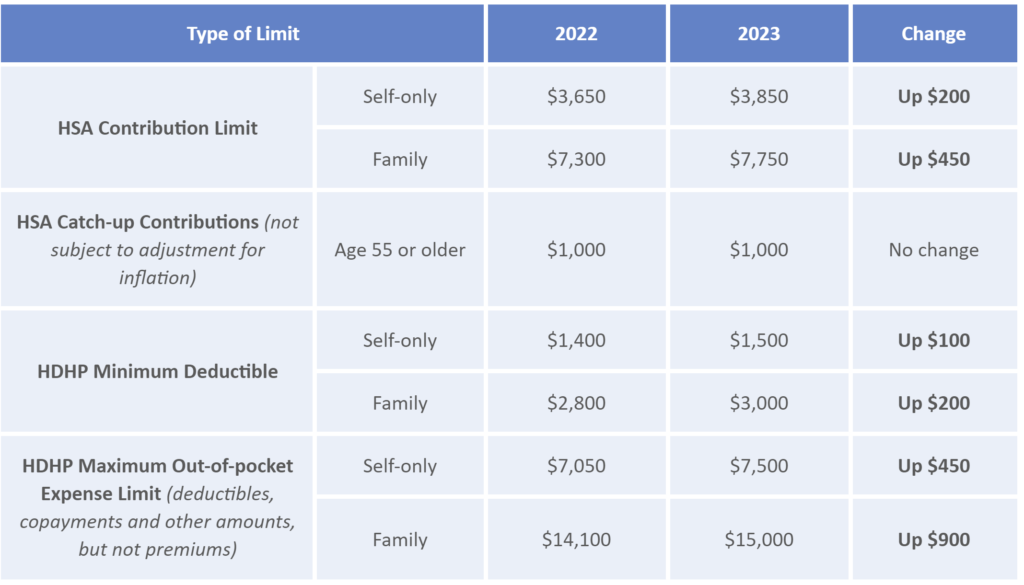

Each year by June 1, the IRS must announce inflation-adjusted limits for health savings accounts and high deductible health plans. On April 29, 2022, the IRS released Revenue Procedure 2022-24 to provide the inflation-adjusted limits for HSAs and HDHPs.

The adjusted HSA limits will take effect on Jan. 1, 2023, and the adjusted HDHP cost-sharing limits take effect for plan years that begin on or after Jan. 1, 2023. These limits include the maximum HSA contribution limit, the minimum deductible amount for HDHPs and the maximum out-of-pocket expense limit for HDHPs. Limits vary based on whether the individual has self-only or family coverage under an HDHP.

HSA Contribution Limits Under HDHPs

Those with self-only HDHP coverage will be able to contribute $3,850 to their 2023 HSAs, up from the $3,650 maximum in 2022. Those with family HDHP coverage will be able to contribute $7,750 to their HSAs for 2023, up from $7,300 for 2022. Anyone age 55 and older may make an additional $1,000 “catch-up” contribution to their HSAs.

New HDHPs increases

The minimum deductible amount for HDHPs will increase to $1,500 for self-only coverage and $3,000 for family coverage for 2023. In 2022, the minimum deductible amount was $1,400 for self-only coverage and $2,800 for family coverage. The HDHP maximum out-of-pocket expense limit increases to $7,500 for self-only coverage and $15,000 for family coverage for 2023. In 2022, the limit was $7,050 for self-only coverage and $14,100 for family coverage.

Employers that sponsor HDHPs should take action and review their plan’s cost-sharing limits when preparing for the plan year beginning in 2023. Employers that allow employees to make pre-tax HSA contributions should update their plan communications for the increased contribution limits.

If you have any further questions about the upcoming limit increases, please contact CanopyNation today at hello@joincanopynation.com.